How to Apply for an Exception With Your Health Insurance

Written by: Julia Flaherty

4 minute read

September 26, 2022

There are many reasons people with type 2 diabetes need to file exception requests with their health insurance. Here’s why that happens and what you can do!

Sadly, not all type 2 diabetes medications, devices and services are covered by health insurance plans, even though they might be necessary or help make your diabetes management more comfortable.

In these cases, people with type 2 diabetes can choose to file exception requests.

What is a health insurance exception?

Exception requests are written requests to your insurance company to cover a medication, medical device or service that a doctor has advised as necessary for treatment. These are different than prior authorization requests or filing appeals.

According to the Centers for Medicare & Medicaid Services (CMS), an exception request is a type of coverage determination. Exception requests are made with all kinds of insurance plans, whether through your employer, Medicare, Medicaid, or the health insurance marketplace. You, your healthcare provider or a designated patient representative may apply for one for you.

Types of health insurance exception requests

When applying for an exception, it may be a tiering or “A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.” (Healthcare.gov)formulary exception request.

- Medicare Interactive explains that you can ask for a tiering exception when “your copay is high because your prescription is on a higher tier than other similar drugs on the formulary.”

- Alternatively, CMS explains that a formulary exception “should be requested to obtain a Part D drug not included on a plan sponsor’s formulary, or to request to have a utilization management requirement waived (e.g., step therapy, prior authorization, quantity limit) for a formulary drug.”

Prior authorizations and appeals are different than exception requests. An appeal is a request to your health insurance to review a decision that denies a benefit or payment. An appeal is filed if/when a prior authorization or exception request is denied.

A prior authorization (PA) is a requirement from your health insurance company for coverage. It requires that your doctor obtain approval from your insurance before covering the costs of a specific medicine, medical device, or service.

You shouldn’t have to worry about knowing which exception request type you need—your doctor and health insurance should know what type of exception request to file to streamline the approval process and get you the drugs or services you require!

When to apply for a health insurance exception

For example, if you currently use long-acting insulin once a day, your insurance may not cover a continuous glucose monitor (CGM) if they require you to be on three daily insulin injections, usually called multiple daily injections (MDI), to qualify. This is a common situation people with type 2 diabetes run into, prompting the need to file exception requests.

Your doctor may note the medical need stems from having multiple hypoglycemic events and a CGM will ensure your safety. Other situations that may prompt the need to file exception requests for type 2 diabetes include requests for:

- Specific types of insulin

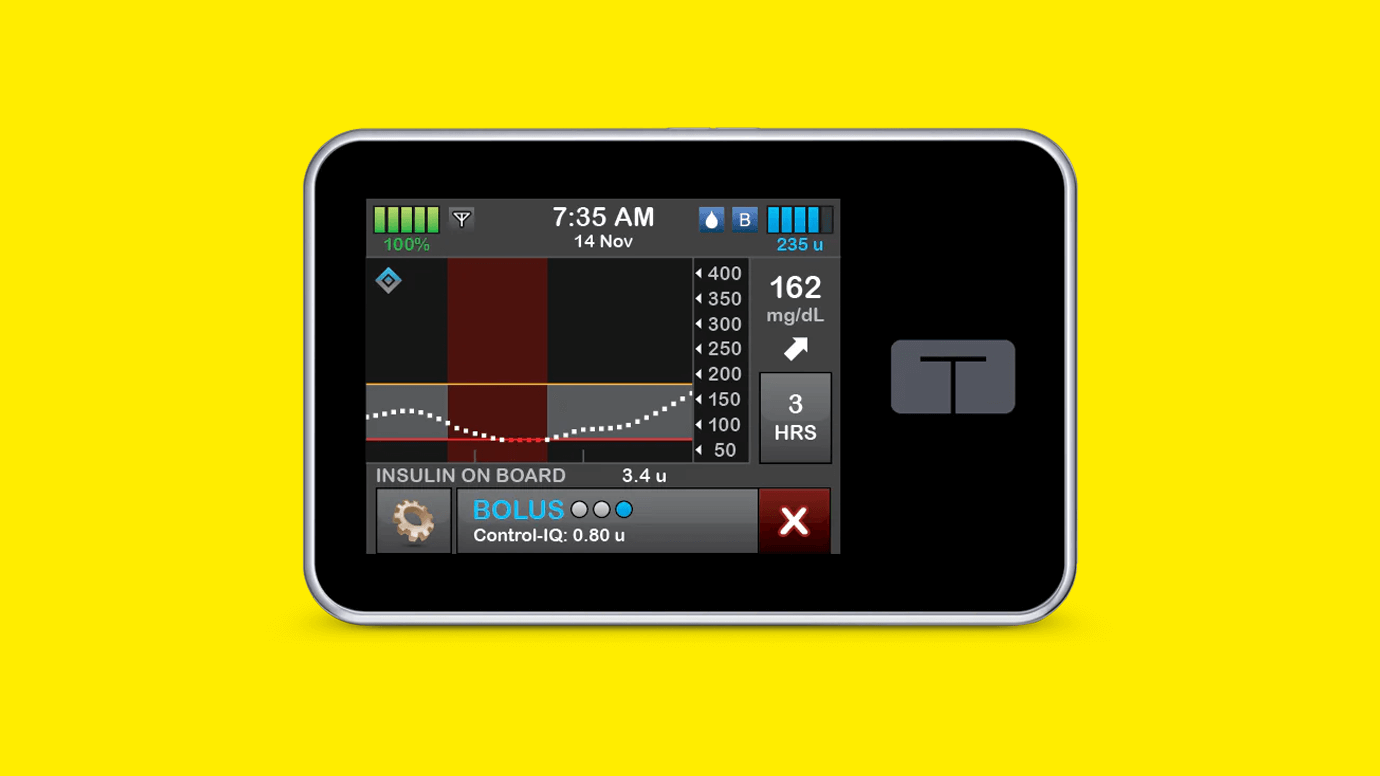

- Insulin pumps

- CGMs

- Seeing specialists

- Other treatments

Anytime your doctor recommends new medicines or supplies, check your plan details through your health insurance website or call your insurance’s customer service line to see if it is covered. Contacting your insurance can help you anticipate whether you may need to enlist your provider’s help to file an exception request.

How to file a health insurance exception request

To submit an exception request, follow these steps:

- Check your plan’s information or formulary to see if treatments aren’t covered.

- Locate the process to submit requests for your plan.

- Contact your doctor to develop and submit your request.

- Ensure you followed all guidelines and made a copy for your records.

- The request will be approved or denied, but you can appeal if the latter is the case.

Think ahead, and ask your insurance to approve your exception for the full extent of your current plan. Doing this is highly beneficial as it can prevent you from having to refile throughout the year! For example, if your plan will last eight more months, request that your exception is approved through that period so that you don’t need to re-apply.

It can save you time (and stress) to ask upfront!

Lean on Beyond Type 2 health insurance resources to strengthen your understanding of the health insurance marketplace, get answers to FAQs and learn more about how you can optimize your health insurance plan to thrive with diabetes.

Editor’s note: Information in this resource is derived from a health insurance guide originally created by JDRF, an active partner of Beyond Type 1 at the time of publication. It has been edited to suit the needs of the type 2 diabetes community.

Author

Julia Flaherty

Julia Flaherty has lived with type 1 diabetes since 2004. She is passionate about empowering others navigating chronic illness and promoting healing through creativity. Julia is a content marketing specialist, writer, and editor with health and wellness coaching certification. She is also the founder of Chronically You, which provides wellness coaching and marketing services. Julia has created hundreds of blogs, articles, eBooks, social media campaigns, and white papers since starting her career in 2015. She is also the author and illustrator of "Rosie Becomes a Warrior," a children's book series in English and Spanish that empowers children with T1D. Julia... Read more

Related Resources

Diabetes clinical trials pave the way for how we manage and treat type 1 and...

Read more

Managing type 2 diabetes with insulin can be challenging, but a new study shows the...

Read more

Editor’s Note: SGLT-2 inhibitors and GLP-1 receptor agonists are medicines approved by the FDA for...

Read more