What to Do When Insurance Won’t Cover the Insulin You Need to Manage T2D

Written by: Julia Flaherty

5 minute read

September 16, 2022

Having trouble getting insurance to cover the insulin you need to manage type 2 diabetes? Here’s why that may happen, how to fix it and when to get help.

While living with type 2 diabetes, getting standard diabetes supplies and medications like insulin, blood sugar meters (BGMs) and continuous glucose monitors (CGMs) covered through your health insurance can be difficult.

In this guide, we explain how to get insulin covered through your health insurance and when to get your doctor involved.

Having trouble getting insulin covered? Check your formulary first!

Not all people with type 2 diabetes manage it with insulin, but those who do tend to encounter problems with insurance coverage of the necessary and helpful medication. You may run into issues with insulin being covered through your health insurance or proving the need for insulin while living with type 2 diabetes. This will ultimately impact your out-of-pocket costs at the pharmacy. In this case, you may need to work with your doctor to get their help proving the need for insulin with your insurance or triple-check to see what type of insulin is on your insurance formulary.

A health insurance formulary is a list of prescription drugs covered by your health insurance plan—sometimes called a drug list. Contact your insurance company or website to determine what is on the formulary first. Your doctor may also have someone at their clinic who can help with this, so bring them into the conversation early and often! If you have a patient portal, you can send your doctor a message rather than wait for your next appointment.

Usually, health insurance websites have a pharmacy page that includes a search tool where you can enter medication names to see what they cost, what pharmacies or direct medical suppliers offer the best price and what your insurance will cover. Use this search function to look up different types of insulins. This tool may bring up a transparent price breakdown and tell you which types of insulins are covered in your plan.

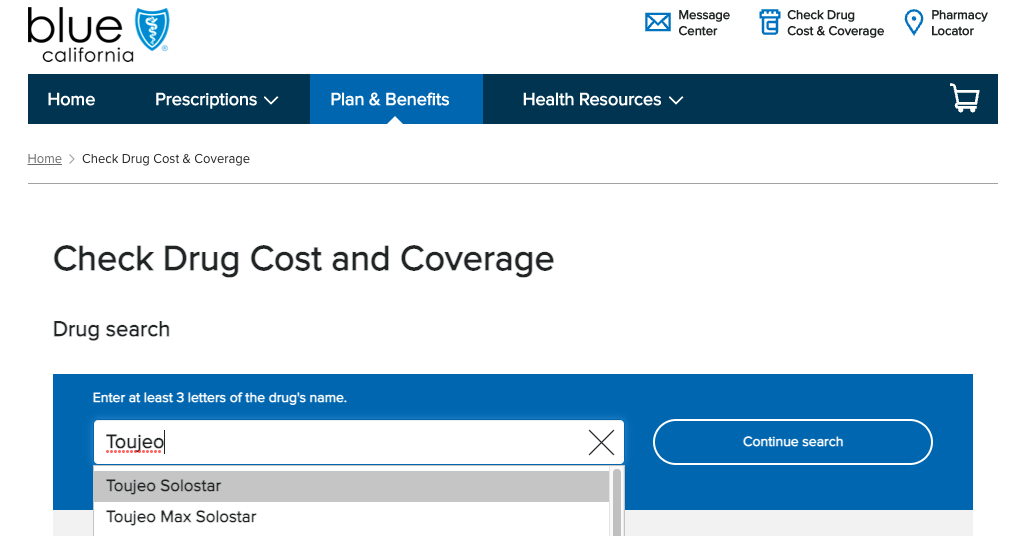

Here is what the search tool may look like:

Step 1: Locate your insurance’s drug cost and coverage calculator.

Step 2: Search for the drug you want to price and determine coverage of.

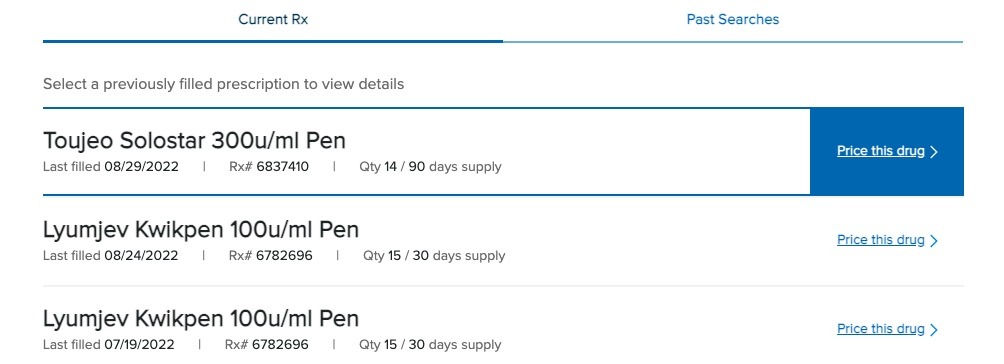

Step 3: Check to see if your preferred drug is covered.

If the drug shows up after you click search, you will see a cost breakdown of the medication, what pharmacies you can pick it up from in your area, which pharmacy offers the best price and whether you can save on a mail-order prescription. If the drug does not show up, this may indicate it’s not covered or you need a prior authorization (PA) to fill it. If the drug shows up and it’s listed at full list price, this may also indicate the need for a prior authorization or the drug not being covered.

Note: If you are having trouble accessing or affording insulin, use the resources at GetInsulin.org.

If your formulary isn’t the issue, get your doctor involved.

Once you’ve ruled out your health insurance formulary as the primary issue, work with your doctor if you need to prove that you need insulin with your insurance. They may need to write a letter to your insurance or speak with a customer service representative.

You may need to work with your doctor on a prior authorization to ensure you get your insulin. A prior authorization is a claim you submit to your insurance company that allows them to review how necessary or effective a medical service or medication may be in treating your condition. A representative from your insurance company or the insurance website will tell you what you need to submit a PA and how to do it if your doctor’s office doesn’t submit them on your behalf.

Before you submit a prior authorization for your insulin, remember:

It is crucial to ensure your prescription covers the amount of insulin you need, so be sure you and your doctor are on the same page about how much insulin you should be taking. Deciding how much insulin you need while living with type 2 diabetes should be a collaborative decision-making process with your doctor.

Your healthcare team should be willing to advocate for you if your insurance does not cover the amount needed. They should be on your team, helping to escalate the approval process.

If you have health insurance, you may qualify for several co-pay cards that can help reduce the cost of insulin at the pharmacy. Use this guide to determine if you are eligible for a relevant co-pay program.

Remember: there is no shame in needing insulin as a person with type 2 diabetes. Insulin is an excellent management tool that can help improve your quality of life.

Recap: Advocating for your health matters most

This guide touches the surface of navigating issues with health insurance coverage while living with type 2 diabetes. As you deal with different concerns, keep your insurance representatives, doctors, pharmacies and all other relevant parties in the loop. These people should be on your team of advocates for whatever issues arise. If they aren’t, it may be time to get new people on your team, where possible!

Of course, the Beyond Type 2 team is here to offer you resources and community to make the experience as seamless as possible.

Join our type 2 diabetes community, where you can ask questions and get help from your peers on all things diabetes management, including insurance.

Author

Julia Flaherty

Julia Flaherty has lived with type 1 diabetes since 2004. She is passionate about empowering others navigating chronic illness and promoting healing through creativity. Julia is a content marketing specialist, writer, and editor with health and wellness coaching certification. She is also the founder of Chronically You, which provides wellness coaching and marketing services. Julia has created hundreds of blogs, articles, eBooks, social media campaigns, and white papers since starting her career in 2015. She is also the author and illustrator of "Rosie Becomes a Warrior," a children's book series in English and Spanish that empowers children with T1D. Julia... Read more

Related Resources

While low blood sugar levels are an unfortunate part of living with diabetes, regaining confidence...

Read more

A delayed diabetes diagnosis isn’t rare, it affects millions worldwide. Behind every missed diagnosis is...

Read more

You count your carbs. You time your insulin. You choose the right foods. You stay...

Read more