What to Do When Insurance Won’t Cover the Supplies You Need to Manage T2D

Written by: Julia Flaherty

4 minute read

September 16, 2022

Having trouble getting insurance to cover CGMs, blood glucose meters or insulin pumps? Here’s what may be happening and how to fix it!

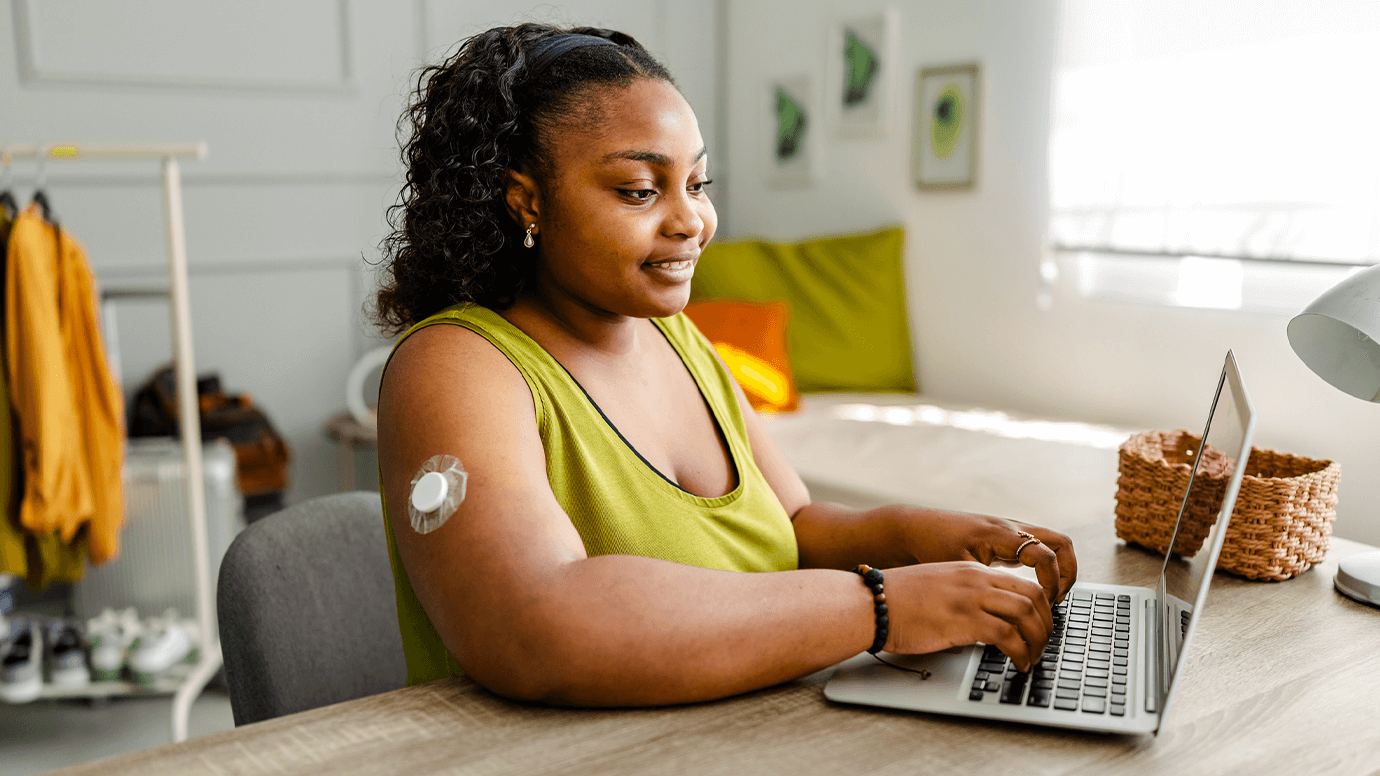

While living with type 2 diabetes, getting standard diabetes supplies and medications like insulin, blood sugar meters (BGMs) and continuous glucose monitors (CGMs) covered through your health insurance can be difficult.

In this guide, we explain how to get CGMs, BGMs and insulin pumps covered through your health insurance and when to get your doctor involved.

Blood glucose meters + test strips

Test strips can give people with type 2 diabetes trouble coverage-wise, as some health insurance plans limit the number of test strips you can obtain over a specific period. If you need more than what they cover, this can lead to costly bills from the pharmacy!

Check your plan’s formulary and specific policy related to testing supplies to find out the necessary details. You can also talk to your doctor about whether the number of times you are testing is the right amount for you.

If you still have trouble affording your test strips, they may be less expensive to purchase over-the-counter (OTC) without running your insurance or through a test strip subscription program. Various retailers and pharmacies offer quality generic equivalents that cost much less than name-brand test strips, and subscription programs often let you order however much you need, however often you want!

The same applies to blood glucose meters. While your plan may cover some name-brand ones, you may find that generic counterparts at the pharmacy or on a retailer’s shelf (like Walmart, Sam’s Club, CVS, Walgreens, etc.) are equal in quality and much less in price. Some test strip subscription programs also offer the opportunity to purchase blood glucose meters.

Continuous glucose monitors + insulin pumps

It may also be challenging to prove the need for a continuous glucose monitor with type 2 diabetes, but they can be an excellent management tool! If you want or need a CGM to manage your diabetes, there are many avenues you can explore to access one.

Utilize these resources if you are having trouble getting a CGM approved with your insurance:

- CGM Access + Affordability: This guide explains the ins and outs of getting your insurance to cover a CGM when living with type 2 diabetes.

- This Program Lets You Try the Freestyle Libre CGM for Free: This program lets you try the Freestyle Libre 2 or 3, a 14-day sensor, for free if you qualify.

- Abbott Patient Assistance Foundation: This program offers financial assistance for various Abbott products if you qualify.

- Hello Dexcom Sampling Program: This program lets you try the Dexcom G6 system for free if you qualify.

- Dexcom Patient Assistance Program: This program offers financial assistance for accessing the Dexcom G6 system if you qualify.

In addition to CGMs, coverage for devices like insulin pumps can also be burdensome. Insulin pump and CGM supplies vary in cost and coverage depending on the brand and your insurance. Prior authorizations might be required to obtain either of these devices.

When encountering pump and CGM issues with your insurance, consulting the company that makes your device may also be helpful. These representatives often have the best insights into accessibility problems and how to resolve them!

Recap: Advocating for your health matters most

This guide touches the surface of navigating issues with health insurance coverage while living with type 2 diabetes. As you deal with different concerns, keep your insurance representatives, doctors, pharmacies and all other relevant parties in the loop. These people should be on your team of advocates for whatever issues arise. If they aren’t, it may be time to get new people on your team, where possible!

Of course, the Beyond Type 2 team is here to offer you resources and community to make the experience as seamless as possible.

Join our type 2 diabetes community, where you can ask questions and get help from your peers on all things diabetes management, including insurance.

Author

Julia Flaherty

Julia Flaherty has lived with type 1 diabetes since 2004. She is passionate about empowering others navigating chronic illness and promoting healing through creativity. Julia is a content marketing specialist, writer, and editor with health and wellness coaching certification. She is also the founder of Chronically You, which provides wellness coaching and marketing services. Julia has created hundreds of blogs, articles, eBooks, social media campaigns, and white papers since starting her career in 2015. She is also the author and illustrator of "Rosie Becomes a Warrior," a children's book series in English and Spanish that empowers children with T1D. Julia... Read more

Related Resources

As the largest payer for health care in the United States, Medicaid relies on federal...

Read more

Diabetes and hormones go hand-in-hand. Each type of diabetes has different ways in which hormones...

Read more

2026 is right around the corner. That means it’s time to start thinking about insurance...

Read more